12

•

W W W . F O R W A R D J A N E S V I L L E . C O M

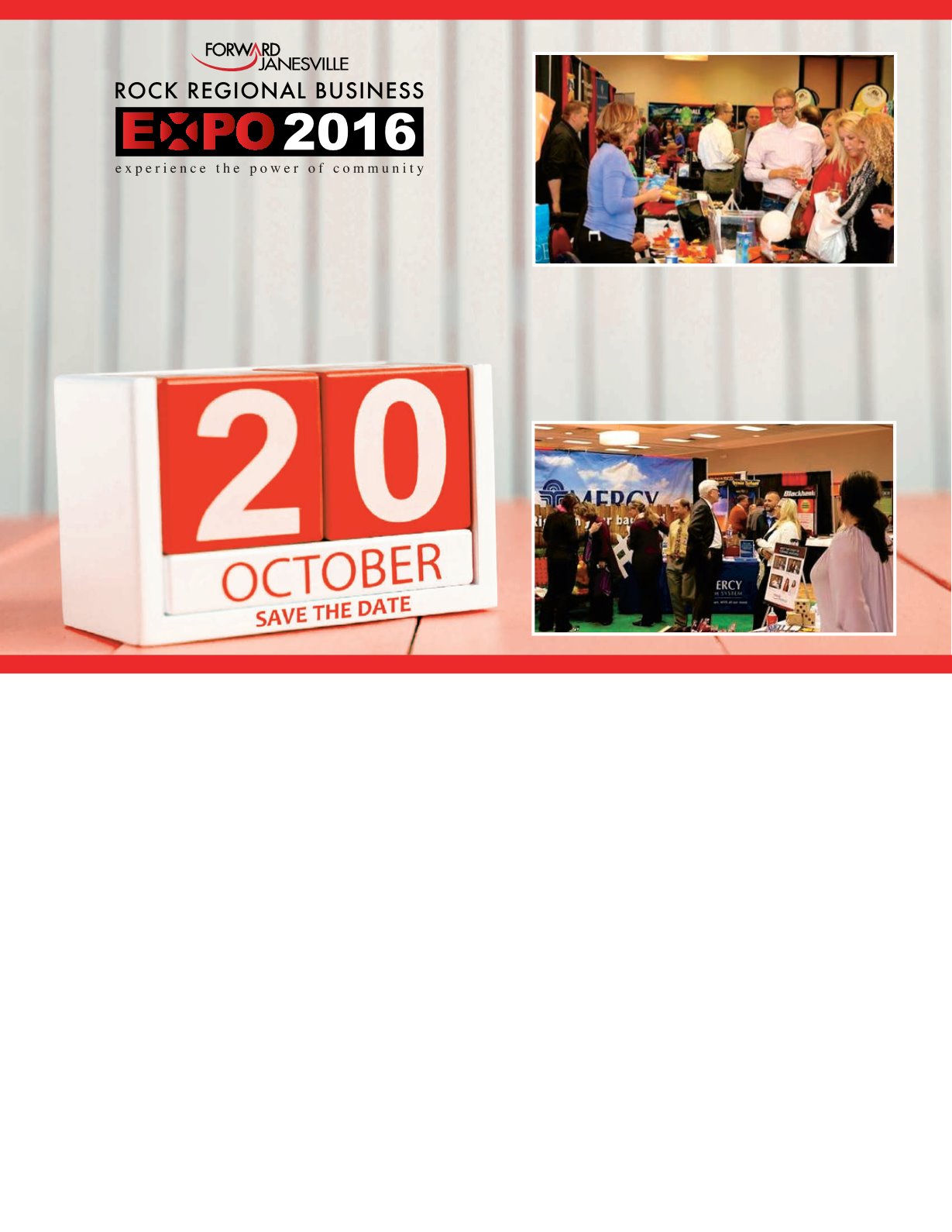

11am-1pm •

Expo Luncheon

with speaker

at the Pontiac Convention Center

1-7pm •

Expo Exhibit Floo

r opens at the

Janesville Convention Center (Holiday Inn Express);

$5 admission

5-7pm • Area’s largest

Business After Five

on the Expo Floor

($675,800) and Franklin ($697,800) received

the least; however, these are prosperous

Milwaukee suburbs that arguably need less

help from the state.

On a per capita basis, Janesville received

$80.45 in shared revenue per citizen. Beloit

led this category; they received $457.68 per

citizen in state shared revenue, while the

second place finisher (Racine) received

$349.77 per citizen.

Cities like Janesville that receive

comparatively low amounts of shared revenue

have asked the legislature to consider

changing the system, but there has been very

little legislative movement on this issue.

According to city staff, the combination of

property taxes and state shared revenue

provides a more accurate depiction of the

revenues available to pay for municipal

services. These two items are inversely

related, meaning that communities who

receive greater state shared revenue can

afford to have lower property taxes, while

communities who receive little state shared

revenue often need to have higher property

taxes to make up the difference. In spite of

receiving little state shared revenue,

Janesville's ability to keep property taxes

relatively low is a testament to the value

residents receive for quality city services.

Here’s how Janesville stacks up when the two

revenue sources are combined (see charts

on page 9).

Janesville receives the lowest amount of

combined property tax and state shared

revenue per person, and there is little that the

city can do to increase either revenue source.

The average amount received by

municipalities in the comparison is $730

(remember, Janesville received $578). If

Janesville received the average amount, the

city would have an additional $9.7 million per

year. That would go a long way to help pay for

an enhanced street rehabilitation program,

capital projects, the ARISE Plan, and the like.

CONCLUSION

When taken as a whole, these numbers

paint an interesting picture. Janesville’s

reputation as a low-cost, high-service city is

backed by the numbers. City administration

has long been frugal, and one could argue

that the city has the capacity to “do a little

more” to fund long-term priorities. However,

there’s only so much that the city can do in

terms of increasing spending without also

increasing borrowing.

It is clear that Janesville’s shared revenue

situation is an impediment to our city’s future

progress. This issue will almost certainly be

on our 2017 state legislative agenda. We

encourage you to join the discussion on this

issue by participating in Forward Janesville’s

legislative program, including Rock County

Day in Madison, our annual lobbying day at

the state capitol. Stay tuned for more

information on this event and other ways to

get involved.

Janesville By the Numbers

Continued from page 9

WATCH FOR MORE DETAILS SOON!

Booth and luncheon registration information will be

available by July 15, 2016.

Visit

www.forwardjanesville.comfor regularly

updated event information.