SUMMER 2016 •

9

rates can be confusing. A lower rate does not

necessarily mean that less is paid in property

taxes. Instead, the rate reflects the ratio of

the total levy to total taxable property values.

The tax rate can increase if the levy rises or if

property values fall.”

Janesville’s property tax levy was just over

$498 per person in 2014/15, trailing only

Sheboygan ($443), Manitowoc ($439), and

Beloit ($389). Brookfield was the highest at

$964 per person; the state median was $589.

Janesville’s property tax rate was $8.15 per

$1,000 of value. The high was $16.54 per

thousand (Racine) and the low was $5.35 per

thousand (New Berlin). The state median was

$8.65 per $1,000 of value.

While the numbers show that Janesville is a

fairly low tax city, other factors are in play.

Municipalities have been subject to limits that

cap increases in property taxes for the last

decade. These limits allow property taxes to

grow at the greater of the rate of new

construction or a fixed percentage, which

used to be set between two and four percent.

However, since 2011, this fixed percentage

has been set at zero, meaning that municipal

levies (and the ability to raise property taxes)

were frozen unless there was new

construction. This fact—combined with

Janesville’s shared revenue situation, which

we will get to in a moment—often leads to

city budget shortfalls.

STATE SHARED REVENUE

According to Municipal Facts, “the state

county and municipal aid program distributes

state income, sales, and excise taxes to local

governments for discretionary use. Beginning

in the early 1970s, shared revenues were

distributed partly based on property values.

Cities or villages with lower per capita

property values received more aid, while

those with high values received less.”

However, the state shared revenue formula

has been frozen since the early 2000s.

Janesville received $5.1 million in state

shared revenue in 2013; the state median

was $5.9 million. The largest beneficiaries of

the shared revenue program were Racine

($27.5 million in 2013), Green Bay ($18.5

million) and Beloit ($16.8 million).

Menomonee Falls ($501,000), New Berlin

$0

$200

$400

$600

$800

$1,000

Janesville

Franklin

Manitowoc

New Berlin

Menomonee Falls

Greenfield

West Bend

Oshkosh

Fond du Lac

Appleton

Green Bay

Sheboygan

Sun Prairie

Eau Claire

Wausau

Oak Creek

Kenosha

West Allis

Waukesha

Beloit

Wauwatosa

La Crosse

Brookfield

Racine

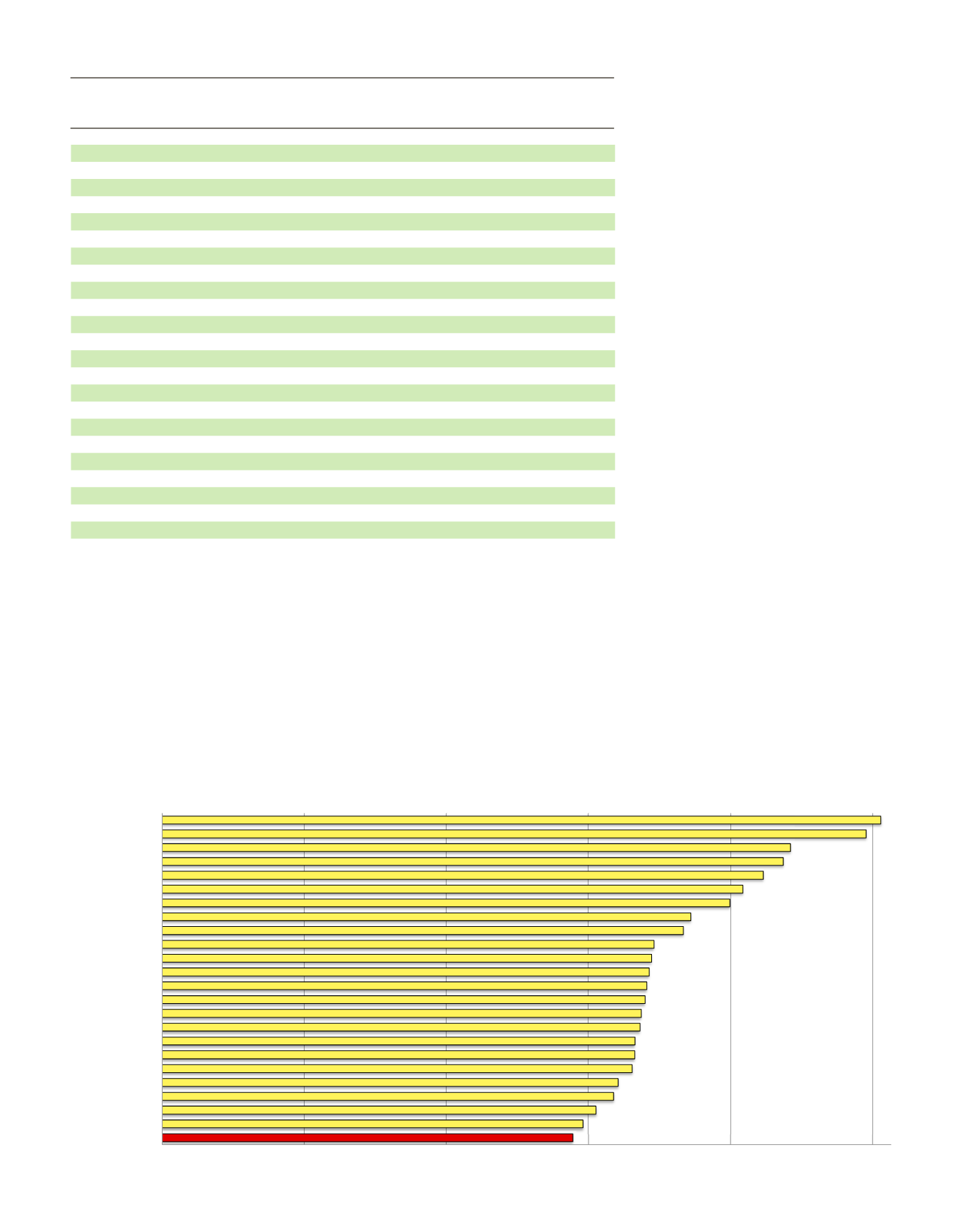

Property Taxes and State Shared Revenue per Capita

Continued on page 12

Total

Taxes+

Total

Property

Total

Shared

Taxes +

Shared

Property

Tax per

Shared Revenue

Shared

Revenue

City

Population

Tax

Capita

Revenue per Capita Revenue

per Capita

Janesville

63,600

31,641

$498

5,116

$80

36,757

$578

Franklin

35,810

20,509

$573

697

$19

21,206

$592

Manitowoc

33,685

14,758

$438

5,813

$173

20,571

$611

New Berlin

39,915

24,682

$618

676

$17

25,357

$635

Menomonee Falls 35,710

22,412

$628

501

$14

22,913

$642

Greenfield

36,770

22,831

$621

1,488

$40

24,319

$661

West Bend

31,425

19,180

$610

1,726

$55

20,906

$665

Oshkosh

66,300

33,333

$503

10,778

$163

44,111

$665

Fond du Lac

43,100

22,860

$530

6,124

$142

28,983

$672

Appleton

73,150

38,390

$525

10,931

$149

49,321

$674

Green Bay

104,300

52,416

$503

18,466

$177

70,882

$680

Sheboygan

48,965

21,677

$443

11,725

$239

33,403

$682

Sun Prairie

30,395

19,582

$644

1,253

$41

20,835

$685

Eau Claire

66,480

38,213

$575

7,575

$114

45,788

$689

Wausau

39,180

22,312

$569

4,805

$123

27,118

$692

Oak Creek

34,695

19,329

$557

6,125

$177

25,454

$734

Kenosha

99,700

60,156

$603

14,034

$141

74,190

$744

West Allis

60,300

39,306

$652

8,881

$147

48,187

$799

Waukesha

70,900

54,546

$769

3,409

$48

57,955

$817

Beloit

36,820

14,300

$388

16,852

$458

31,152

$846

Wauwatosa

46,705

39,050

$836

1,783

$38

40,833

$874

La Crosse

51,600

34,150

$662

11,478

$222

45,628

$884

Brookfield

37,835

36,495

$965

990

$26

37,485

$991

Racine

78,700

52,085

$662

27,527

$350

79,612

$1,012

Source: Wisconsin Taxpayer Alliance publication MunicipalFacts15

1. Total amount in $1,000's (not "per capita")

PEER CITY FINANCIAL ANALYSIS - REVENUES (2013)